In the ever-evolving panorama of investment strategies, the inclusion of gold in Individual Retirement Accounts (IRAs) has garnered important attention. As conventional belongings face volatility and economic uncertainties loom, traders are increasingly trying in the direction of gold as a means of preserving wealth and guaranteeing financial safety in retirement. This text explores the rationale behind investing in IRA gold, the mechanisms concerned, and the potential advantages and drawbacks of such a strategy.

Understanding IRA Gold

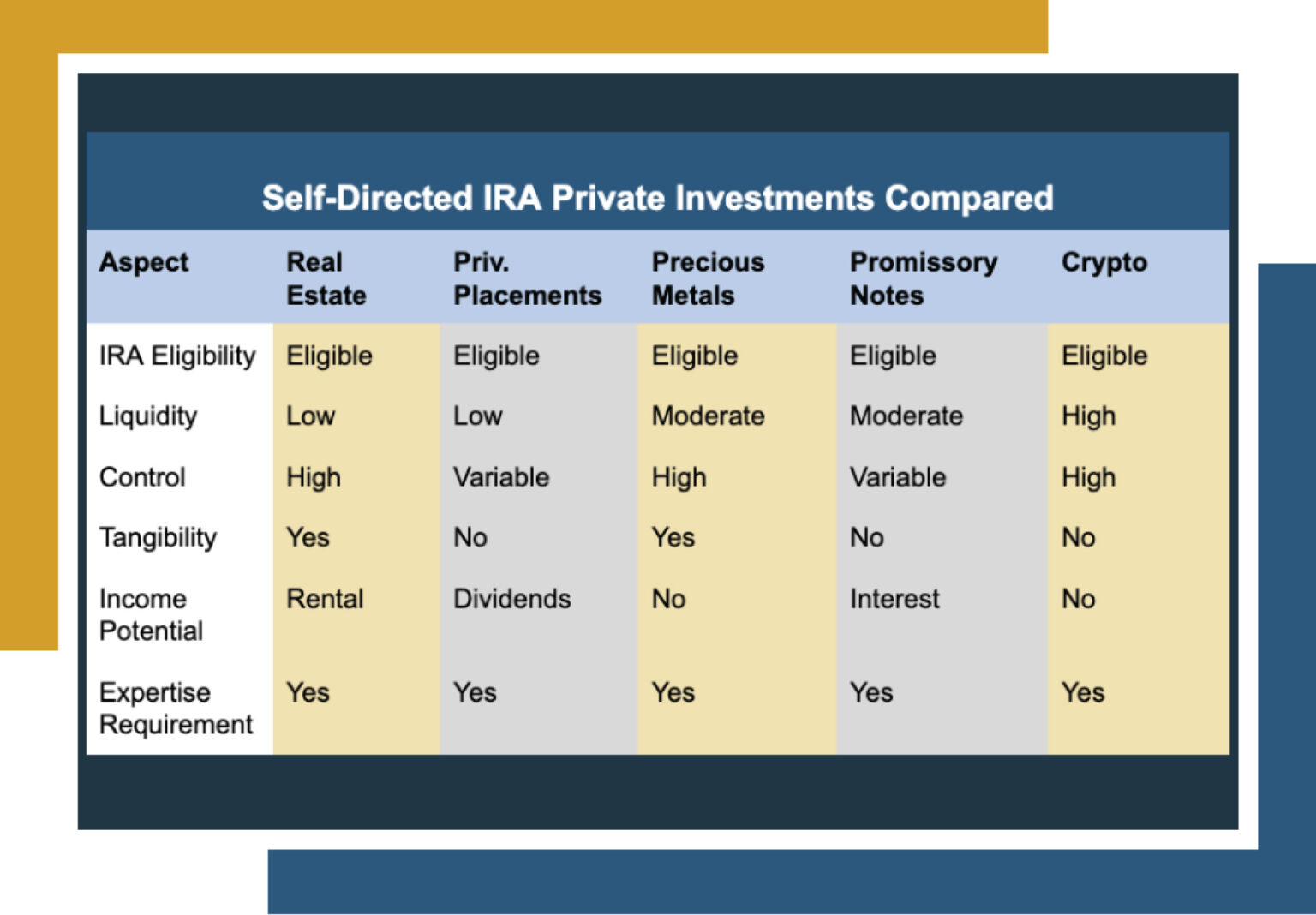

An individual Retirement Account (IRA) is a tax-advantaged account designed to assist people save for retirement. While traditional IRAs primarily hold stocks, bonds, and mutual funds, a self-directed IRA allows for a broader range of funding choices, including physical gold and different valuable metals. The IRS has particular rules relating to the kinds of gold that can be included in an IRA, which typically must meet certain purity requirements and be produced by an accredited mint.

The Historical Significance of Gold

Gold has been a symbol of wealth and a medium of exchange for 1000's of years. Its intrinsic worth and restricted supply make it a compelling asset during times of financial uncertainty. Traditionally, gold has acted as a hedge against inflation and foreign money devaluation, sustaining its buying power when paper currencies falter. This historic significance is one among the first reasons buyers consider together with gold in their retirement portfolios.

Why Put money into IRA Gold?

- Inflation Hedge: One of the most compelling causes to invest in gold is its capacity to function a hedge towards inflation. As the cost of dwelling rises, the value of forex typically diminishes. Gold, then again, tends to retain its value over time, making it a sexy choice for preserving buying energy.

- Diversification: Diversifying an investment portfolio is essential for managing risk. Gold typically has a low correlation with different asset courses, such as stocks and bonds. By including gold in an IRA, buyers can scale back overall portfolio volatility and enhance long-term returns.

- Crisis Safety: Financial downturns, geopolitical tensions, and monetary crises can result in market instability. Gold has historically carried out nicely throughout such instances, offering a secure haven for investors trying to protect their assets.

- Tax Benefits: Like other investments held within an IRA, gold investments can develop tax-deferred till withdrawal. If you have any thoughts regarding exactly where and how to use best ira gold custodians, you can speak to us at our own site. This can result in significant tax savings in comparison with holding gold outdoors of an IRA, the place capital positive aspects taxes might apply.

- Tangible Asset: In contrast to stocks or bonds, gold is a physical asset that traders can hold. This tangibility can provide a way of security, especially during occasions of financial turmoil.

The right way to Put money into IRA Gold

Investing in gold through an IRA includes several steps:

- Choose a Self-Directed IRA Custodian: Not all custodians allow trusted options for ira rollover in gold the inclusion of bodily gold in an IRA. Buyers should choose a custodian that makes a speciality of self-directed IRAs and has experience with treasured metals.

- Fund the IRA: Investors can fund their self-directed IRA by varied means, together with rollovers from present retirement accounts, contributions, or transfers from different IRAs.

- Select Accepted Gold Merchandise: The IRS has strict pointers relating to the forms of gold that may be included in an IRA. Eligible products typically embody gold bullion coins and bars that meet a minimal purity normal of 99.5%. Common choices include American Gold Eagles, Canadian Gold Maple Leafs, and gold bars from accredited refiners.

- Storage: Physical gold have to be saved in an IRS-authorised depository. Traders can not take possession of the gold whereas it is within the IRA. This requirement ensures that the funding stays compliant with IRS regulations.

- Monitor and Handle: As with any funding, it is essential for buyers to watch their reliable gold ira rollover providers holdings and keep knowledgeable about market situations. Adjustments to the portfolio may be crucial based on altering financial factors.

Potential Drawbacks of IRA Gold

While investing in gold via an IRA offers numerous benefits, it is not without its challenges:

- Charges and Prices: Organising a self-directed IRA and buying gold can contain various charges, together with custodian charges, storage fees, and transaction prices. These bills can eat into potential returns.

- Limited Liquidity: Promoting bodily gold can take time and should involve extra prices. Unlike stocks, which might be bought quickly on exchanges, liquidating gold requires discovering a buyer and negotiating a worth.

- Market Volatility: While gold is commonly seen as a protected haven, it isn't immune to market fluctuations. Prices can be influenced by numerous factors, together with interest rates, foreign money strength, and geopolitical occasions.

- IRS Rules: The IRS has specific guidelines relating to the types of gold that can be held in an IRA. Traders must ensure compliance to avoid penalties or disqualification of the account.

Conclusion

Investing in IRA gold could be a strategic move for individuals seeking to diversify their retirement portfolios and protect their wealth from economic uncertainty. With its historic significance, inflation-hedging properties, and potential for lengthy-term growth, gold remains a priceless asset in the fashionable funding landscape. Nonetheless, it is essential for buyers to fastidiously consider the associated prices, regulations, and market dynamics earlier than committing to this technique. As with all investment, thorough research and skilled guidance will help individuals make informed decisions that align with their financial goals and retirement plans.